Therefore TDS or tax which is deducted, by the organization or company is deposited with the Income Tax department. So Form 16 in turn serves as proof of the same. Companies or organizations need to issue Form 16 to their workers on or before 31st May of the financial year. Therefore employees who want to file this form, may download it from the below-given link and follow the instruction to fill without errors.

How to fill Form 16

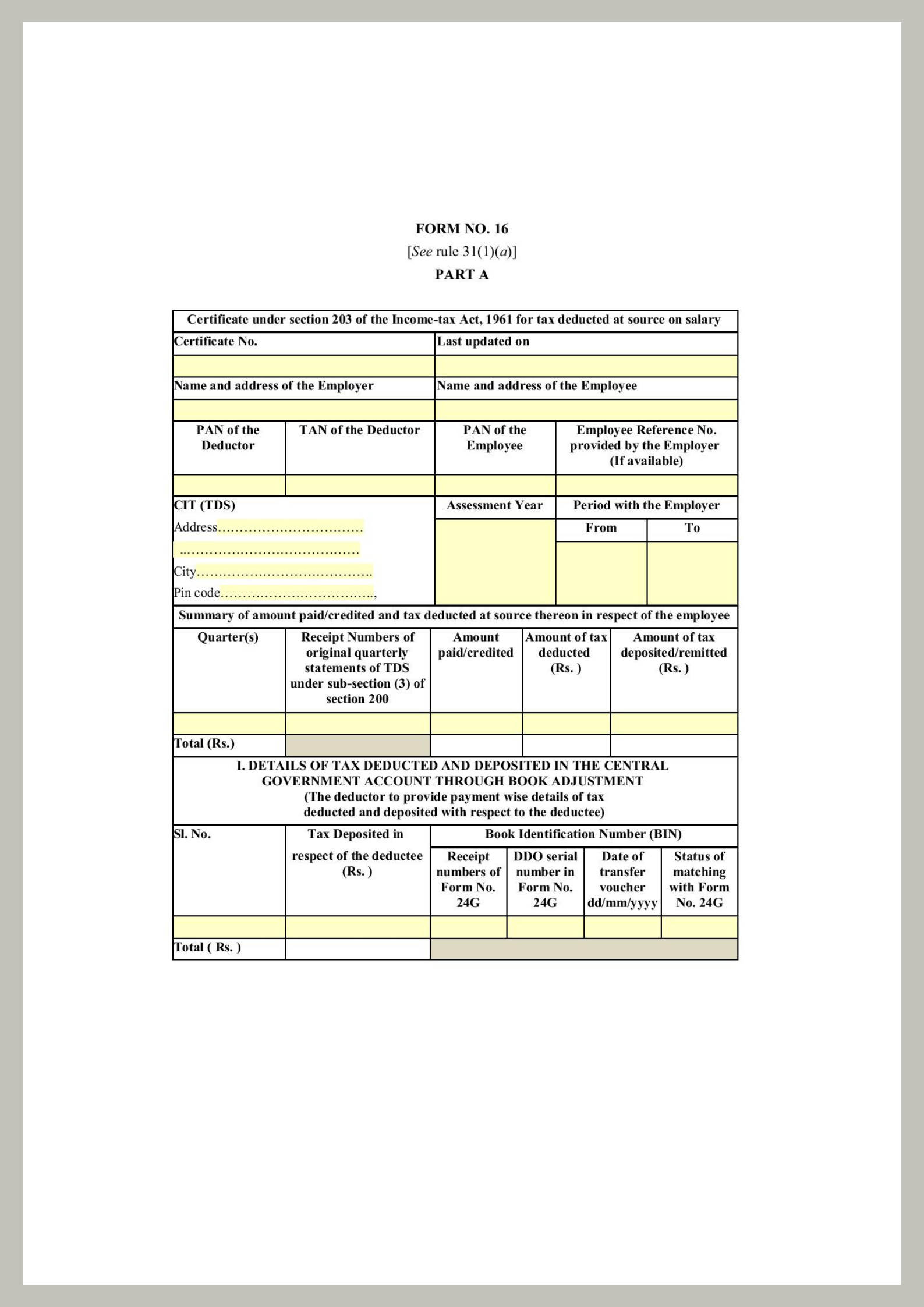

generally, this form contains Part A and Part B.

Part A:

- Part A contains the Personal information of the employer (company) as well as the employee.

- Name of the employer (tax deductor)

- Address of the employer (tax deductor)

- Name of the employee

- Address of the employee

- PAN of the employee

- Permanent Account Number or Aadhaar Number of the Deductor (employer)

- Address of the employer

- TAN details of the employer: TAN refers to the number assigned to an account responsible for the deduction and collection of tax

- Assessment Year (AY) details: As the name shows, this refers to the year in which the income is getting calculated and works on the tax return processes.

- Then specify the details of the time period for which the person was employed with the company in the particular Financial Year

- Summary of the salary paid (1. Amount paid/credited 2. Amount of tax deducted 3. Amount of tax deposited/remitted)

- Mention the date of tax deduction from the salary

- Mention the Date of tax deposit in the account of the central government

- Summary of tax deducted and deposited quarterly with the Income Tax Department

- Acknowledgment Number of the TDS Payment

Part B:

Part B of this form has the subdivision details of how your tax was calculated. As the investment declaration, you made at the beginning of the Financial Year. Then the proof of investment submitted directly.

It also contains the details of other payments that your company provided to you. Such as medical bills, house rent, home loans, and assistance which are exempt from taxation that you may have provided to the employer.

- a) Your gross salary

- b) Allowances to the extent exempt u/s 10

- c) Balance

- d) Deductions:

(1) Entertainment allowance

(2) Tax on employment

An aggregate of d(1) and (2)

e )Income chargeable under the head ‘Salaries’ (3-5)

- f) Add: Any other income reported by the employee

- g) Gross total income (6+7)

- h) Deductions under Chapter VI-A (A) sections 80C, 80CCC and 80CCD (a) section 80C

- i) Aggregate of deductible amount under Chapter VIA

- j) Total Income (8-10)

- k) Tax on total income

- l) Education cess @ 3% (on tax computed at S. No. 12)

- m) Tax Payable (12+13)

- n) Less: Relief under section 89 (attach details)

Benefits of Form 16:

- Proof of income

- Help in filing Income Tax Return

- A document stating how your tax was calculated and check any irregularities

- Loan assessment and approval

- One document to check all your tax-saving investments

- Visa issuance

- This serves as a Document of the tax credit

- On switching jobs: it helps the next company to calculate your tax charges on the basis of what your previous company has already deducted

However, Form 16 is the most valuable document for a salaried person. With this certificate, the taxpayer can simply prepare their income tax return by themselves, without seeking the help of financial planners or Chartered Accountants. This is more valid for individuals, whose only source of income is the monthly salary.