RTGS is primarily used for large transactions. In RTGS the payments will be processed individually on gross settlement and real-time basis. In the gross settlement, the transfer of funds will be made in the form of instructions. RTGS is used to remit a minimum of 2 Lakh rupees and a maximum of 1 crore rupees. No charges are charged for this transaction. If the amount is transferred through RTGS, the beneficiary will receive the amount remitted within 30 minutes. These transactions are initiated 24×7 through retail and corporate Internet banking.

NEFT is used to facilitate a secure, efficient and reliable system for transferring funds. A form has to be submitted for the credit of the amount by NEFT. The minimum limit time for NEFT is half an hour. The fund’s transfer before 6:30 pm will be credited on the same day. If the transfer is made after the time, the amount will be credited on the next day as per the rules of RBI.

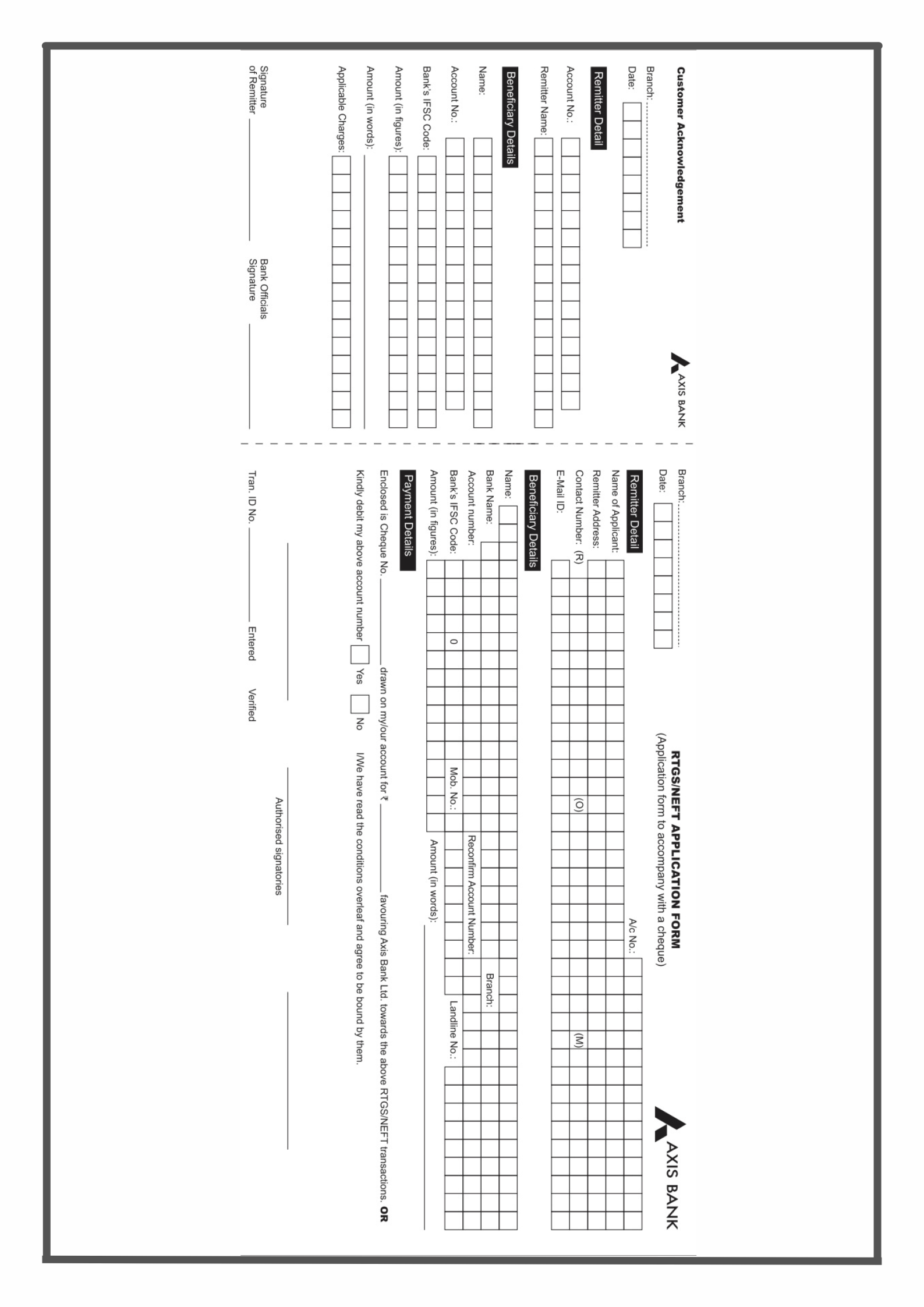

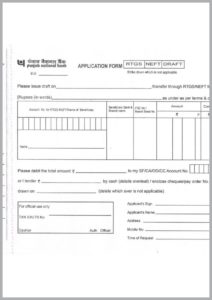

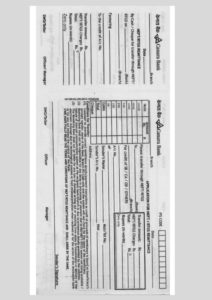

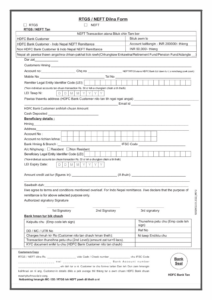

Axis Bank RTGS / NEFT Form PDF Download

The form for the transactions RTGS or NEFT can be downloaded by the link mentioned below. The form can be filled and submitted either online or offline.

The user can get the form offline also. They should visit the bank’s branch and get the form from there.

Details to be filled in Axis bank RTGS / NEFT form

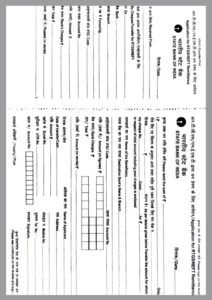

The form contains two parts.

The first part is the acknowledgment of the customer. The below details should be filled in it.

- At first, fill in the details of the Branch name and date.

- Remitter Details:

- Enter Account Number

- Remitter

- Beneficiary Details:

- Name

- Account Number

- Bank’s IFSC code

- Amount in figures

- Amount in words

- Applicable charges

- Signature of Remitter

The second part should be submitted to the bank.

- At first, fill in the details of the Branch name and date.

- Remitter Details:

- Name of Applicant

- Remitter’s Address

- Contact Number

- E-Mail ID

- Beneficiary Details:

- Name

- Bank Name

- Bank’s Branch

- Account Number

- Reconfirm Account Number

- Bank’s IFSC code

- Mobile Number

- Landline Number

- Amount in figures

- Amount in words

- Payment Details:

- Enclosed is Cheque Number

- Amount of rupees

- Tick the confirmation whether it is Yes or No regarding the RTGS/ NEFT A declaration signature should be mentioned at the end of the form.

Axis bank RTGS / NEFT Transaction Charges:

A minimum amount is charged against the transactions done for NEFT as specified below.

For Real-time gross settlement systems (RTGS): No charges

For National Electronic Funds Transfer (NEFT):

- Up to Rs. 10000: Rs. 2.50

- Rs. 10000 – Rs. 1 lakh: Rs. 5

- Rs. 1 lakhs – Rs. 2 lakhs: Rs. 15

- Above Rs. 2 lakhs: Rs. 25

Submission of Axis bank RTGS/ NEFT form pdf:

The customers of Axis bank have two options for submitting the form online or offline. If it is online, they can upload it and send it to the concerned branch. If they want to submit it offline, they can submit it personally in their branch.

We are happy to provide you with various pdf forms that might be useful for your benefit. We don’t want our users to get confused. So, a systematic description process for filling the form is given to make it easy. Axis bank customers can make use of the form to perform their transactions.