The method of paying money through the Demand Draft is a faster and cheaper process. The DD is used as an alternative to a cheque and is treated as more secure when compared to the cheques as they are pre-credited to the purchaser’s account. Due to this reason, there is no bouncing back like that of cheques.

What is DD Form SBI ?

DD is expanded as Demand Draft. It is one of the payment instruments that are issued by the State Bank of India (SBI). This method of payment is used to transfer the amount from one place to the other. The Demand Draft is used for the payment of fees, donations, business transactions, property transactions, application fees, legal payments, remote payments, tours and travels, gifts, settlement of debts, etc. The DD is a secure and versatile way of transferring funds. The option of Demand Draft is availed when personal cheques are not accepted or electronic transfers are not feasible or convenient.

SBI DD form:

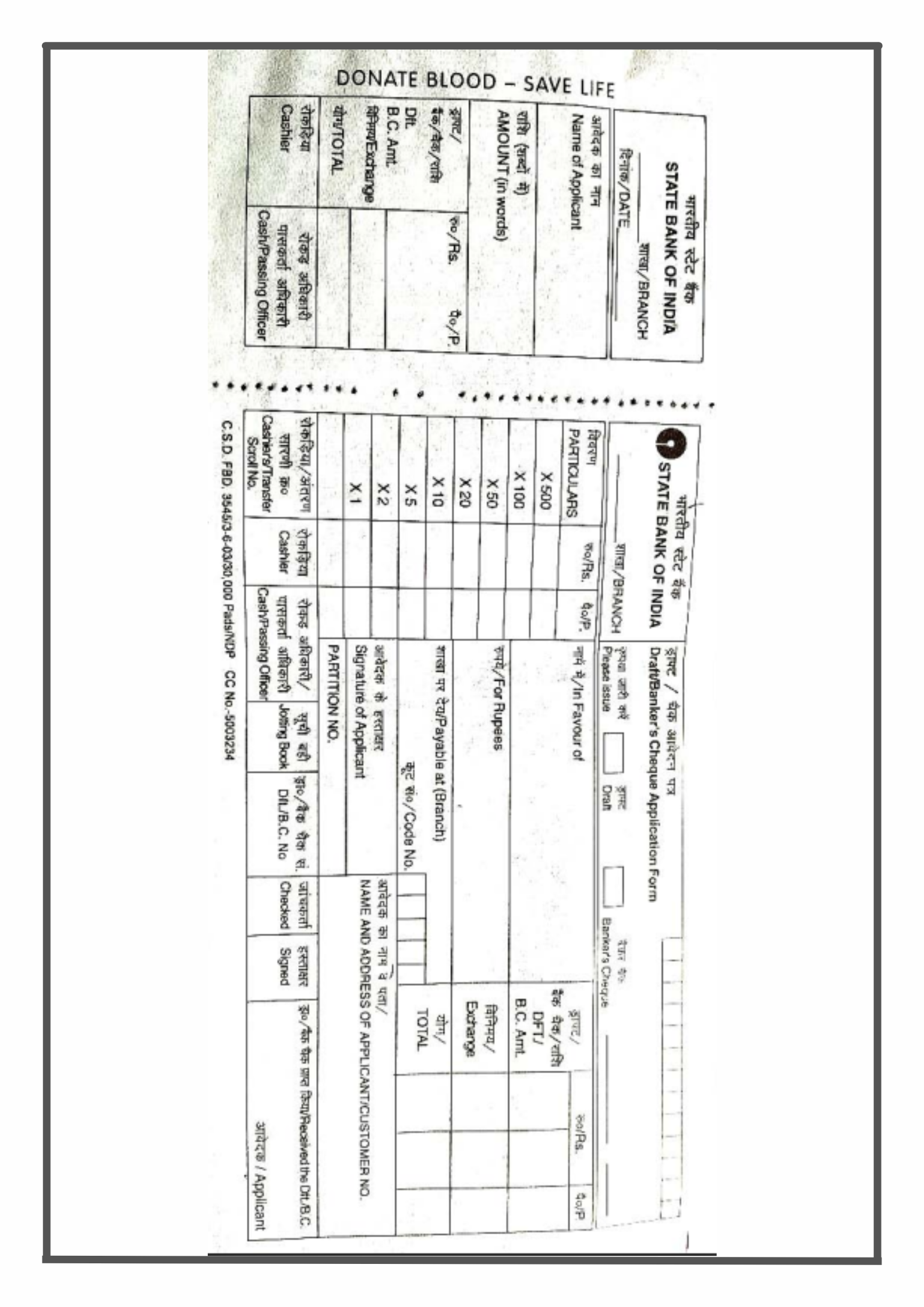

The DD form of SBI is printed with the heading “State Bank of India: Draft/ Banker’s Cheque Application Form”. The form contains two parts. Left part and the right part. The left side part is the customer’s copy and the right side part is the bank’s copy. The customer should check and tick in either of the options “Draft” or “Bankers Cheque”.

Fields to be filled in the DD form:

- The details are to be filled in the left part of the form.

- Branch: The bank branch at which the DD is taken

- Date: The date on which the DD is drawn

- Name of the Applicant: The person who draws a DD

- Amount (In rupees): The amount paid is to be mentioned in numbers

- Total: The total amount is to be written as numbers.

- The fields are to be filled in the right part of the form.

- Branch Name: The branch name of the bank where the DD is taken has to be written

- Date: The DD taken date has to be noted.

- In Favor of: The name to which the DD is drawn should be mentioned

- For Rupees: Mention the amount in words.

- Payable at (Branch): At which branch the amount is paid

- Total: The total amount along with the included charges to be written in the space provided.

Denominations of the money: The amount given in which notes or rupees have to be written in the column of particulars x 500, x 200, x 100, x 50, x 20, x 10, x 5, x 2, and x 1.

Name and address of applicant/ customer No: The name and address of the person who draws the DD should be mentioned.

Signature of Applicant: The concerned person who visits the bank to draw a DD should sign at the space provided.

After filling out the form, the customer should submit the form to the bank staff. The staff checks whether all the columns are filled properly and finally signs and stamps on the two slips of the form. The left side of the form is given to the customer and the right side form is maintained at the bank. The customer should keep the DD slip safe as it acts as proof of transaction.

Charge applicable for SBI Demand Draft:

To draw a demand draft some minimum charges based on the amount of transaction are charged from the customer. They are listed below.

- Up to Rs. 5000: Rs. 25 (Including GST)

- From Rs. 5000 to Rs. 10000: Rs. 50 (Including GST)

- From Rs. 10000 to Rs. 1 lakh: Rs. 4 (including GST) per Rs. 1,000, Min. Rs. 600 (including GST), and Max. Rs. 2,000 (including GST)

- Above Rs. 1 lakh: Rs.4 per thousand or part thereof, with a minimum of Rs.600 and Maximum of Rs.2,000.

The process of how to apply for a Demand Draft is produced to the user by our website www.getpdfform.com. The users can use the data given on our page and can perform the Demand Draft transaction. The customers of SBI can make use of the DD option to meet their needs.