RTGS is one of the processes of transferring the amount from one account to the other account through online or offline. The RTGS is used to transfer an amount more than two lakhs where as NEFT (National Electronic Fund Transfer System) is the process of transferring amount that is less than two lakhs. The transaction is used for a large value money for the inter bank transactions, government transactions and the business payments.

What is an RTGS?

RTGS is known as the Real Time Gross Settlement. It is used in the financial sector that is used to initiate the electronic fund transfer between any two banks or the financial institutions. The RTGS is used for the purpose to settle transactions of large-value instantly on a one-to-one basis without any need of any clearing house or the intermediary.

The person who wants to perform the RTGS transaction should know the other persons account number, branch name, code and IFSC code to which account the amount has to get transferred.

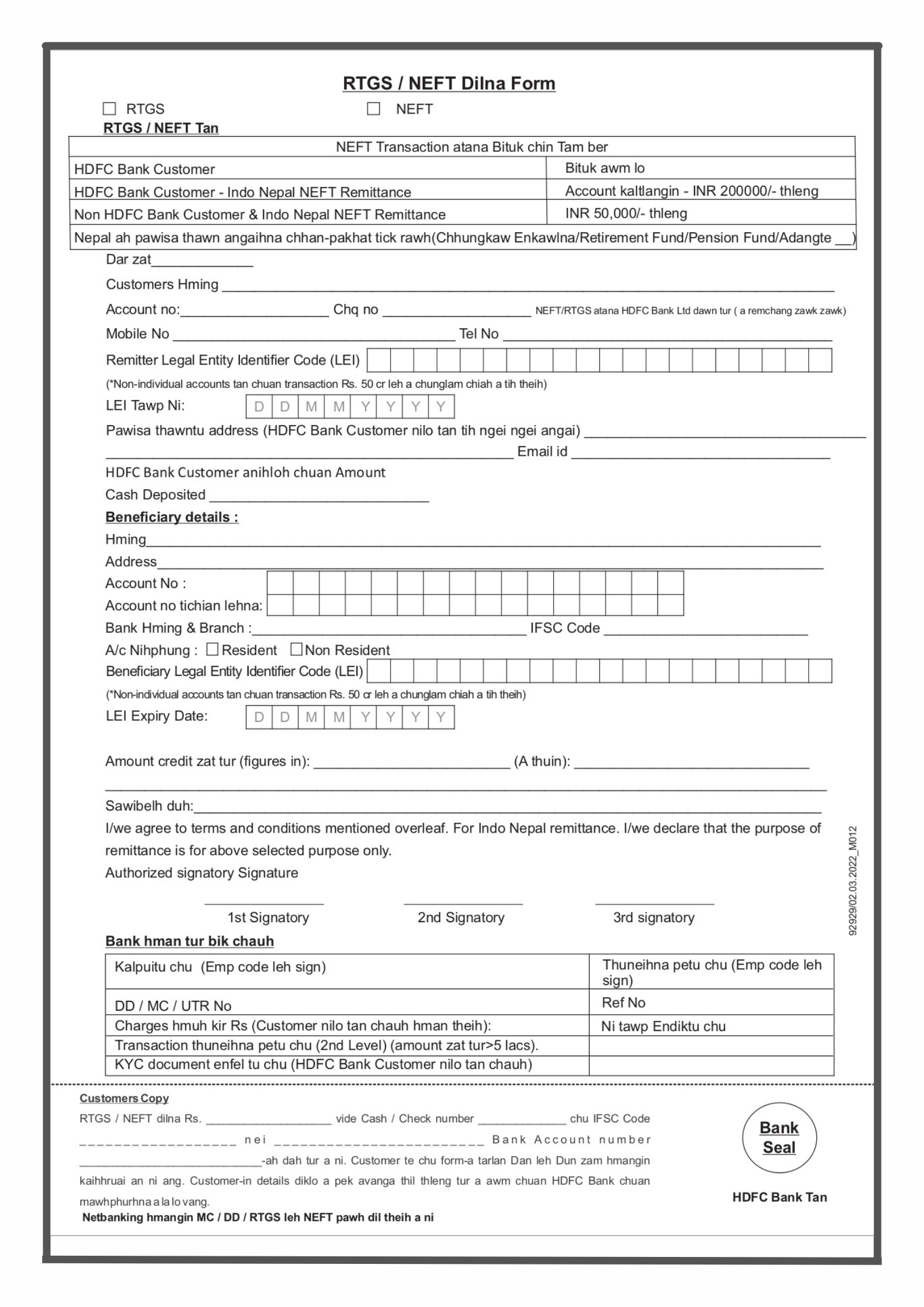

Details of HDFC RTGS / NEFT Form PDF

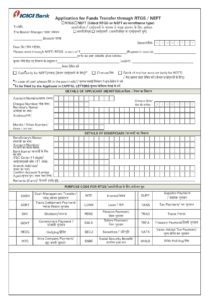

The form is provided with a heading “Application Form for Funds Transfer through Real Time Gross Settlement (RTGS) / National Electronic Funds Transfer (NEFT)”. The form is divided into two parts. The upper part contains the “Beneficiary Details”. And the lower part contains the “Remitter Details”. The customer of HDFC bank has to choose and check the transaction weather it is RTGS or NEFT.

- Branch Code / Name

- Date

- Time

HDFC RTGS / NEFT Form Beneficiary Details:

The person to whom the money was sent is called the Beneficiary.

- Beneficiary Name

- Beneficiary Account Number

- Beneficiary Address

- Beneficiary Bank Name & Branch

- Beneficiary Bank IFSC Code

- Account Type : Resident / Non Resident

- Amount (in figures) to be credited

HDFC RTGS / NEFT Form PDF My / Our Details (Remitter)

The person who sends the money is called Remitter.

- Remitter (Applicant) Name

- Remitter Account Number

- Cash Deposited (Non HDFC Bank Customer)

- Mobile / Phone Number of Remitter ( Mandatory)

- E-Mail Id:

- Address of the Remitter (Mandatory for Non – HDFC Bank Customer)

- Remarks

All the necessary details of the beneficiary and the remitter should be filled and at the last the remitter should sign at the space provided near the field of “Signature of Authorized Signatory”. A “Customer Acknowledgement” is present at the end of the page. After the transaction is completed, the bank issues an acknowledgement for the transaction completed. The acknowledgement should be saved as a proof of transaction that is to be used further.

HDFC RTGS / NEFT Form PDF Download:

The form of RTGS can be downloaded from the official website of HDFC. That is through the online mode. The form can be attained from the concerned bank’s home branch. The filled in form has to be submitted in the remitter’s bank branch. The process of transaction thus gets completed.

The RTGS transaction can be performed in the online mode. For the process the account holder has to login with their official account to their internet banking account. The beneficiary has to be added to their account by providing the name and account details. It takes 24 hours time for the beneficiary to get added. Once the beneficiary gets added, the transfer of the amount can be performed easily.

The users of the website www.getpdfform.com can visit and can check the topic for more details about the topic and clarify their doubts. The customers of the HDFC bank can perform the transfer of amount through the processes of RTGS or NEFT formats. The online and the offline methods for the amount transfers can be known by the account holders of the bank for their easy access to fulfill their needs.