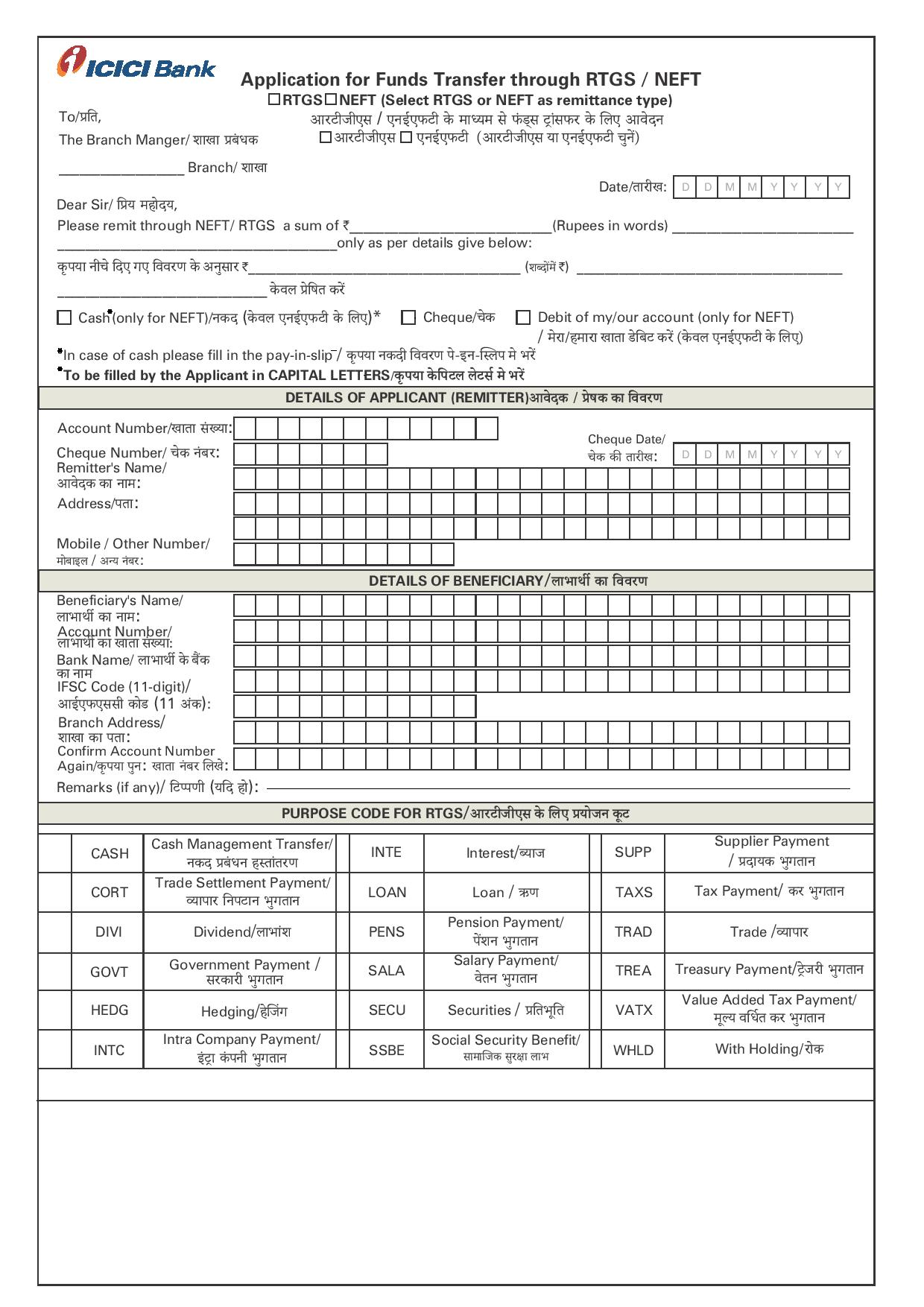

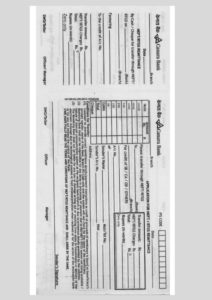

ICICI This bank RTGS form is available in both languages that are in English and Hindi. The form can be filled out online, and then converted into a pdf file, and downloaded and submitted to a bank branch. Otherwise, Senders can also visit the bank branch directly and take a hard copy of the form.

What is there in ICICI Bank RTGS form?

- Details of the Applicant/ remitter

- Remitter account number: specify the account number of the sender

- Cheque number: mention the cheque number for the RTGS transfer

- Remitter name: name of the sender who is sending money

- Address: address of the sender who is making the transaction

- Mobile Number: Mobile Number of the sender, for communication

- Details of the Beneficiary

- Beneficiary name: name of the person who is receiving money

- Beneficiary account number:

- Bank name: Name of the bank where the Beneficiary is holding an account

- IFSC code: 11 digits of the IFSC code of the branch

- Branch Address: Beneficiary Branch Address

- Mention account number: again mention the Beneficiary account number.

Procedure to fill ICICI Bank RTGS Form:

The bank customers need to fill up the following details in the RTGS form.

Step 1: download the ICICI Bank RTGS Form and fill in the Date, PAN card Number, Amount to be sent through RTGS

Step 2: enter the sender details such as

- Name

- Address

- Email address

- Phone number

- Signature

Step 3: Then specify the beneficiary details

- Name

- Bank name

- Email address

- Contact number

- Account number

- Branch IFSC code

- Account type (savings/ current/ credit card)

Step 4: Next enter the payment details

- Amount to be transferred

- Additional charges

- Cheque number if paying through cheque

- Bank branch address and bank account number if paying through the account.

Step 5: then hand over it to any ICICI bank branch, then bank official will verify the data in the form and forward the payment to the beneficiary account

According to RBI guidelines, every bank must make the payment within 30 minutes. In case if the payment is not credited to the beneficiary bank account within the stipulated time. The sender can raise a complaint at the ICICI bank customer service or at the grievance cell of the Reserve Bank of India.

Advantages of using the ICICI bank RTGS service:

- This bank account Holders Need not to Visit Bank for RTGS form Transactions

- This is a Secure, safe, and fast Way of Transferring the amount

- All the RTGS transactions have Legal Backing

- There is no upper limit in RTGS Transactions

ICICI Bank Charge of RTGS Service?

- The Amount above 2 Lakh Rupees up to 5 Lakh – Rs 20+ GST

- The Amount above 5 Lakh Rupees up to 10 Lakh – Rs 45 + GST.

Important details: every bank has some terms and conditions where applicants should follow during registration and transferring funds. Check some of the instructions while submitting the RTGS form

- Applicants should give correct information in the form

- Money transactions are done during working days

- Confirm all particulars are correct, and there is enough balance before transferring.

- In case the sender account has not had enough money the process will be rejected.

We hope the given information in this article is useful for those who are new to the RTGS service. However, the ICICI RTGS service enables an efficient, secure, and reliable system to transfer money from bank to bank.