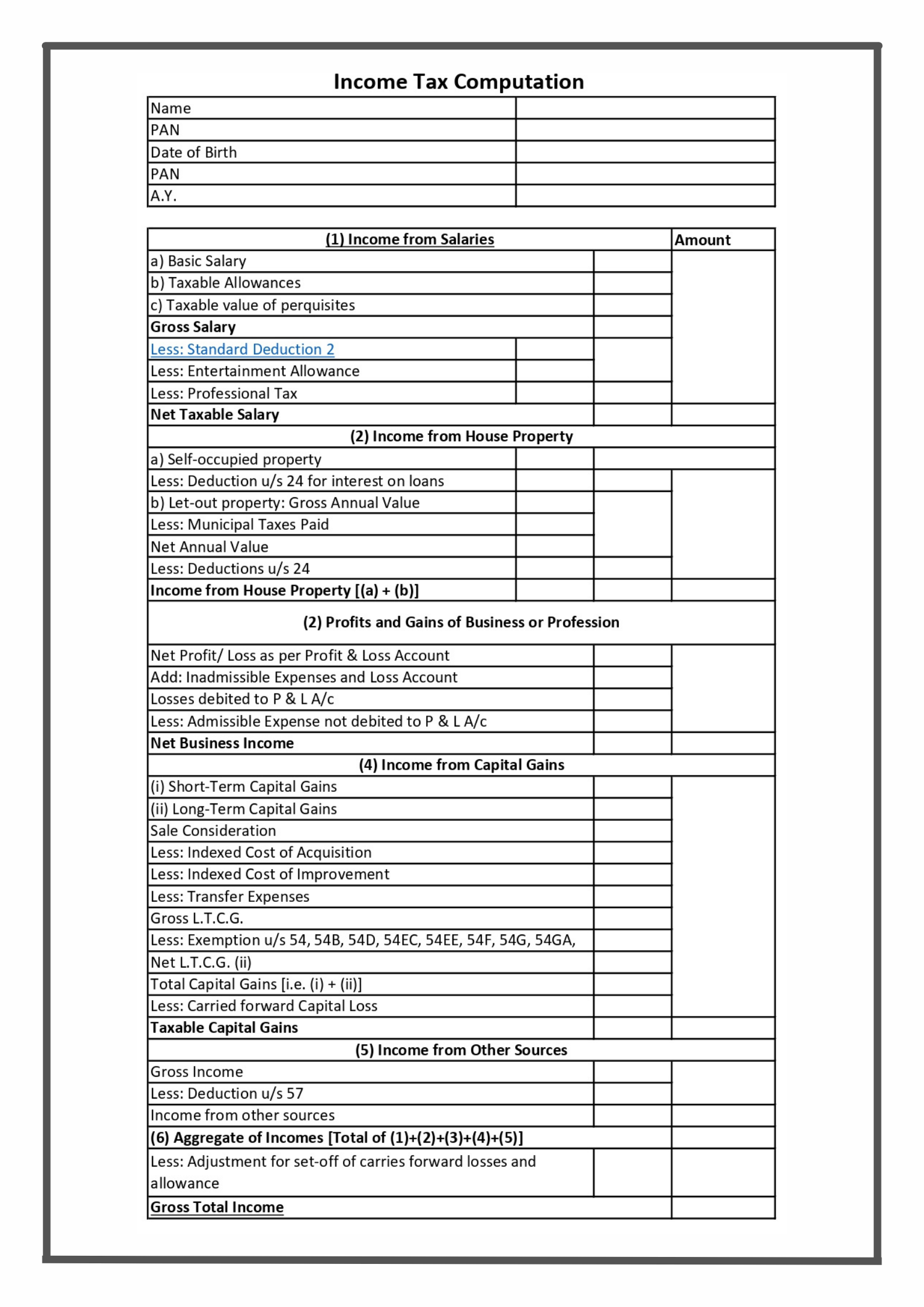

Income Tax Computation format pdf download : The form for Income Tax computation can be downloaded from the below-given link. The applicant can also get it from any of the charted accountant’s offices of the Income Tax department.

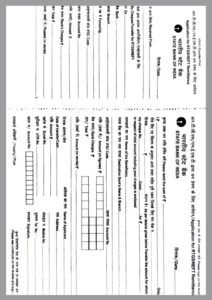

Income Tax Computation Format details to be filled

Following are the details to be filled in the form for filing Income tax.

Name

PAN

Date of Birth

PAN

A.Y

- Income from salaries (In Amount)

- Basic Salary

- Taxable Allowances

- Taxable value of perquisites

Gross Salary

- Less: standard deduction 2

- Less: Entertainment Allowance

- Less: Professional Tax

Net Taxable Salary

- Income from House Property (In Amount)

- Self-occupied property

Less: Deduction u/s 24 for interest on loans

- Let-out property: Gross Annual Value

Less: Municipal Taxes Paid

Net Annual Value

Less: Deductions u/s 24

Income from House Property [(a) + (b)]

3. Profits and Gains of Business or Profession

Net Profit/ Loss as per Profit & Loss Account

Add: Inadmissible Expenses and Loss Account

Losses debited to P & L A/c

Less: Admissible Expense not debited to P & L A/c

Net Business Income

- Income from Capital Gains

- Short-Term Capital Gains

- Long-Term Capital Gains

Sale Consideration

Less: Indexed Cost of Acquisition

Less: Indexed Cost of Improvement

Less: Transfer Expenses

Gross L.T.C.G.

Less: Exemption u/s 54, 54B, 54D, 54EC, 54EE, 54F, 54G, 54GA,

Net L.T.C.G. (b)

Total Capital Gains [i.e. (a) + (b)]

Less: Carried forward Capital Loss

Taxable Capital Gains

- Income from Other Sources

Gross Income

Less: Deduction u/s 57

Income from other sources

Aggregate of Incomes [Total of (1)+(2)+(3)+(4)+(5)]

Less: Adjustment for set-off of carries forward losses and allowance

Gross Total Income

Less: Deductions

Less: Deductions (u/s 80C to 80U)3

80C (Investment in specified schemes) 4

80CCC (Pension Fund) 5

80CCD (New pension scheme) 6

80D (Mediclaim) 7

80EE (Interest on loan for the first residential house) 8

80G (Donations) 9

80GG (Rent Paid) 10

80TTA (Saving Bank A/c Interest)

80TTB (Interest on Bank/ Post Office Deposits in case of a senior)

Others

Taxable Income (R/o to the nearest rupees ten)

Net Agricultural Income

Computation of Tax Liability

Income Tax on Short-term Capital Gains from the transfer of securities (u/s 111A) 11

Income Tax on Long-term Capital Gains (u/s 112) (u/s 111A) 12

Income Tax on Long-term Capital Gains form equity shares/ units of an equity-oriented mutual fund (u/s 112A) 13

Income Tax on Taxable Income plus Agricultural Income fewer capital gains (as above)

Total

Less: Relief on Agricultural Income

Income-Tax Payable 14

Less: Rebate u/s 87A

Net Income Tax Payable

Add: Surcharge

Add: Cess 15

Total Tax Payable, Surcharge, and Cess

Less: Relief u/s 86 and 89(1)

Balance Tax Liability

Add: Interest payable (if any) for delay in filing of return (u/s 234A) or short payment/ deferment of advance tax (u/s 234B & 234C)

Total

Less: Tax Deducted/ Collected at Source

Less: Advance Tax paid

Balance Tax and Interest Payable on Self Assessment/ Balance Refundable

Submission of Income Tax Computation form / Computation of Income pdf

The filled-in form of Income Tax can be submitted online by uploading the required documents through the official website.

We provide you with varied pdf forms that may be helpful for you in many ways. Users can download the forms and avoid confusion by following the simple steps that are presented for them. All the taxpayers should download the form provided in the link to proceed for payment of tax and make clear all the doubts by the given article.