An ATM Card is an important and essential part of today’s banking industry. This card is provided by every bank to all the current and savings account holders. The main feature of the ATM card is flexibility. Yes, the account holder can access their bank account from anywhere at any time. Therefore, after opening an account with any bank, an ATM card is automatically sent to the account holder’s address.

Thus, the new ATM card is sent to the existing customers on the expiry of the old ATM Card. But, for the Replacement of the ATM card, the account holder has to approach the nearest bank branch. However, it is necessary for every bank customer to know how to use an ATM card to deposit or withdraw money to make PoS transactions.

Types Of SBI ATM Cards: State Bank of India provides 18 types of ATM cards to make easier day-to-day transactions for its account holders. Therefore, SBI account holders can choose from this wide range from classic SBI ATM cards to global international currency debit cards to make their daily transactions convenient. Thus each of the ATM cards comes with transaction requirements, withdrawal limits, and numerous benefits. Hence all types of SBI ATM Cards are designed according to the account holder’s requirements and spending habits of each customer. So SBI customers must have any one of the 18 cards to make their daily money truncations.

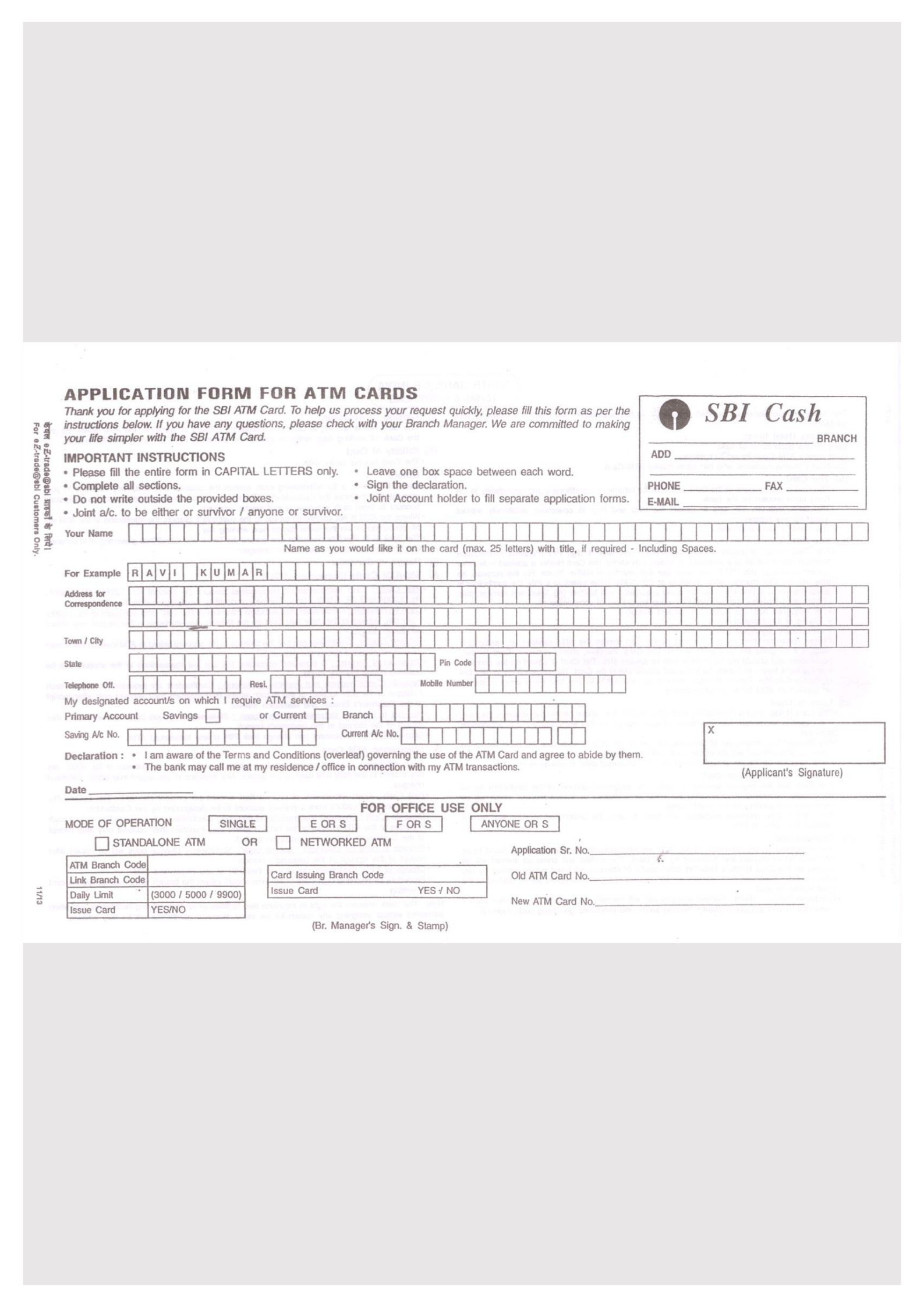

Procedure to fill Application form: SBI Bank account holder those who want to apply for an ATM card can follow the given steps.

- First, visit any nearest SBI branch or download the Application form below given link

- Read the instruction on the Application form carefully

- Fill in the basic details like

- Name

- Address for communication

- City

- State

- Pin Code

- Mobile number/Telephone number

- Next, make a tick mark on the primary account details. Such as choose Savings or Current

- Mention branch name and account number

- Read the declaration and make a signature on the space provided

- Attach any one of the below mentioned document as ID proof

- Then submit the ATM Card Application form in our bank branch

Note: fill the entire SBI ATM card application form with Capital Letters only

SBI ATM Card Apply form Download

Required Documents: while submitting the SBI ATM Card application form in any one of the nearest bank branches. Applicants have to attach the Xerox copy of any one of the below-mentioned documents.

- Aadhar Card

- Driving License

- PAN Card

- Voter ID card

- Passport.

Benefits of ATM card: ATM card provides various benefits like

Quick Cash Withdrawal, getting account balance inquiry, Details of recent transactions, Request for the new checkbook. Another most important feature is safety and security because ATM services are restricted only to the person who knows the PIN number. However, ATM card hold doesn’t worry about the bank timing and bank holidays because they can withdraw cash 24 x 7, 365 days a year anywhere.

However, an ATM card is an important card in everyone’s life. Because a card account holder can withdraw money, deposit money to a self or others account, and can swipe to pay money in a shopping mall or grocery store. Hence ATM cards are used for every money transaction.