Nowadays, the online banking system is a popular platform in various banks in India. Therefore RTGS is the best way to transfer funds online. The process is fast, easy, secure, and no delays or waiting for several working days. Bank account holders can access many services without visiting the bank branch.

What is RTGS: the Full form of RTGS is a Real-Time Gross Settlement system. This system is applicable for money transactions above or equals to the amount INR 2 lakhs. This is an electronic system that processes payment dealings accepted between two banks. Also, these transactions are stable on a non-stop, real-time, and separate basis. Also, there is no exact time for payment via the RTGS process as it works throughout the day.

Information Required For RTGS

Amount Transfer

Beneficiary Account number

Name of the beneficiary customer

Name of the beneficiary bank

Account number of the beneficiary customer

IFSC code of the Beneficiary Bank branch.

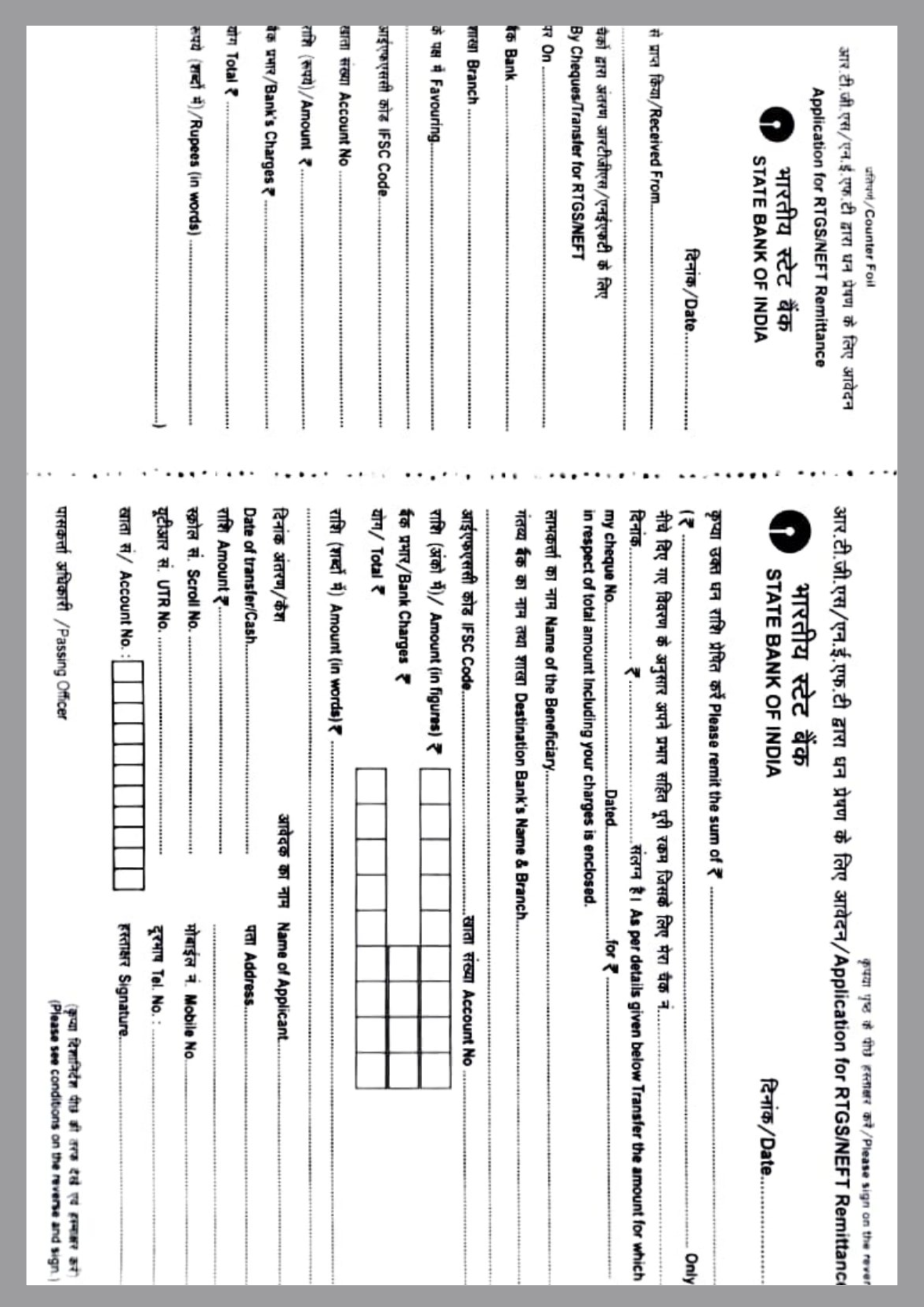

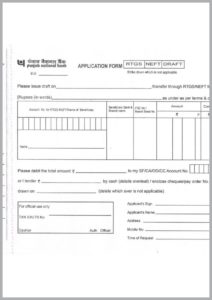

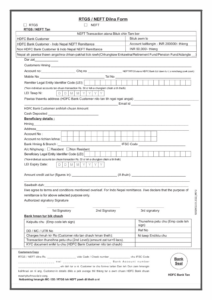

How to Fill SBI Bank RTGS Form: SBI bank has both online and offline mode of money transfer according to customer’s preferences. But RTGS is the best way to make transactions online. For this applicant should fill in all mandatory information in the form. Then submit that form either online or at any bank branch.

- The SBI RTGS application form is divided into two separate divisions as left and right.

- The left side section is for the customer to fill in all the details and specify the proof documents.

- The right section is left for the bank officials to confirm the details after filling

- The RTGS form needs you to enter the Sender Account Details, Beneficiary Bank Account Details, Beneficiary Bank IFSC Code and Amount need to be transferred, name of the applicant, address, telephone number, and signature.

- Enter the amount to transfer, bank charges, and make your signature

- Cross-check that all given details are correct before submitting the form

- Then submit the document to the bank officer, they will enter all the particulars in the bank computer

- As the amount is higher than the Rs. 2 lakh SBI customer will have to give a cheque along with the RTGS form

- In case customer forgot their checkbook then the bank will arrange a temporary checkbook

- The originating/sender and destination/beneficiary bank branches are included in the RTGS scheme.

SBI RTGS Charges: RBI has not fixed the particular price for the RTGS services. So every bank has the freedom to charge the customers according to their rates. However, the RTGS charges apply from Rs. 25 to Rs.56 this depends on the money you transfer. Therefore the higher amount draws a higher charge.

However, the Real-Time Gross Settlement System (RTGS) enables a secure, efficient, and reliable system of transfer of funds from bank to bank. As well as from the remitter’s/senders bank account in a particular bank to the beneficiary’s bank account in another bank across the country.